Subsidence or Settlement? Either way there’s no need to panic!

What is the difference?

Settlement normally occurs early in the life of a property whereas subsidence can occur at any time. In a large part of the South East of England we have large areas of Clay Subsoil and movement of this is the main cause of subsidence problems. Subsidence is normally covered by insurance whereas settlement is not.

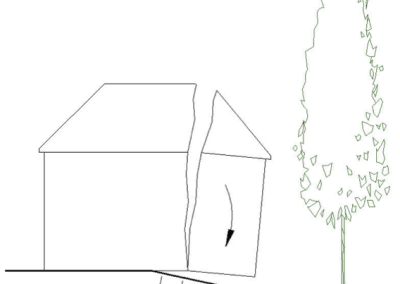

In many cases there is enough inherent strength in a building for it not to crack, however, if the volume change of the supporting soil is enough, at some stage the structure will fracture allowing the unsupported section of the building to drop.

This often results in tapered cracks extending up through the building accompanied by rotational movements.

The ground tends to move with the seasons as its moisture content changes. Most modern buildings have foundations that are deep enough to avoid the bulk of this ground movement. Even for properties with shallow foundations this ground movement may not be a problem if the movement is uniform. Variations of movement across a building are where problems occur.

Trees, often the “root of the problem…”

Underpinning often concerns clients, but is really not as worrying as you think. In effect, underpinning is a practical way of putting the foundations under a building that should have been there originally. It could be argued, therefore, that the underpinned building is actually better than a neighbouring building that has not been underpinned. The underpinned building now has the correct foundations whereas the non-underpinned building has a potential for a future subsidence failure.

My building has Subsidence – what do I do?

Within our fixed price survey report we can give some limited advice on subsidence but we normally recommend a more detailed report to give you better advice on what may happen. The reason for this will become clear once you read the next section!

Once you have the Chartered Structural Engineers Report you send this along with a claim form to the Insurance Company and they will normally appoint a Loss Adjuster who will handle how the claim is dealt with. It is important for you to know what your insurance policy covers before the first meeting with the Loss Adjuster.

Depending on the insurance company, they may appoint a team on your behalf to deal with this matter and although, on the face of it, this seems a good approach, often it is far from it. I have met many cases where the people dealing with the claim do not seem to understand subsidence. If things are not dealt with correctly, then it can leave you with potential future problems. My concern with this approach is the aim seems to be to get the job done as cheaply as possible and not necessarily dealing with things in the correct way.

The problem you have if the loss adjuster appoints the design team is that there is no-one directly looking after your interests. In cases where you have no say in how the works are managed, we can assist by providing an overview of the events and giving you the help you need to ensure the end solution is acceptable. However, in most cases, our fees for this work are not covered by the insurer.

If you opt for the more detailed report then as well as giving more detailed advice on what I think is happening, I try to list what investigation works are required and what remedial works are likely to be required. This will at least give you an idea of what to expect and if things do not seem to follow my suggestions you can at least ask why?

If the loss adjuster says they are to appoint the design team, it is worth checking that your policy says this approach must be followed, as some loss adjusters intimate this is the case, so they can get the work for their own firm’s subsidiaries. Ask to be shown the policy wording that says this approach must be followed.

If the policy does not specifically say that you must use the insurer’s appointed team then you can have your own engineer to oversee the claim and their ‘reasonable fees’ are covered by the insurance. If this is the case, then we would be pleased to assist in dealing with this matter for you.

Our advice is to find out if you have the option to have your own Engineer acting for you and if you do… TAKE IT!

I therefore recommend that, on completion, you get a letter from the insurer confirming they will offer continuing insurance to you at ‘normal market rates and with no adverse conditions’ and also pass on cover to a future owner under the same terms, subject to their completion of a satisfactory application. It is then important to ensure that you do not let your policy lapse as some insurers will not reinstate after a lapse in policy, then we would be pleased to assist in dealing with this matter for you.

Other Causes of Subsidence

In addition to problems due to clay shrinkage there are a number of other possible subsidence causes.

Granular Soils:

In granular soils, like sands and gravels, leaking drains can wash away the fine content of the soil and this produces a change in volume of the soil which can lead to subsidence. In granular soils, where subsidence is suspected, it is normal to check drains and water mains for leakage. Trees do not usually affect granular soils as they are normally non-shrinkable.

Chalk Soils:

Most chalk is non-shrinkable and so trees do not normally cause a problem. Sometimes, however, there are areas of clay over the chalk or the upper layers of chalk can have a clay content. and so tests normally have to be carried out to determine the soil characteristics when assessing a potential subsidence problem. Leaking drains can dissolve or soften the chalk resulting in foundation movements so again drain testing is normally carried out.

In chalk, you can get ‘Swallow Holes’ or ‘Solution Features’ which are where a void forms below ground. These are normally hidden from view but under the right conditions the capping over it can fail and a void open up. If this happens below a house the damage can be significant.

Mine Workings:

In coal mining areas, there can be substantial ground movements from old mine workings as they collapse but luckily this is not prevalent in the Beds, Herts and Bucks area. There are chalk mines in this area and in particular around Stevenage. where we have had to deal with a 6m deep hole opening up below the corner of a client’s house.

Insurance Issues

If you are certain your house has no problems, changing the insurer is no real issue but often the lay person may not recognize their house has a problem. If you change insurer and a subsidence problem is identified soon after the change, there may be a problem deciding which insurer should cover it.

The Association of British Insurers (ABI) says that if a claim is made within the first eight weeks of the changeover, the previous insurer will deal with it. Claims between 8 weeks and 1 year will be handled by the new insurer with the cost of settlement shared equally between the two insurers. This agreement, the ABI say, is subscribed to by the “majority of household insurers.”

The problem occurs when there are signs of historic damage as well as the new damage. If the historic damage was not notified to the new insurer when the policy is taken out they may not cover the repairs or could even cancel the insurance due to non-disclosure.

If you swap insurance each year and a subsidence problem is identified that may have started some time ago then this can become extremely difficult to resolve.

It is a better prospect to insure with a main stream insurer and to stay with them long-term to build up a provenance so if a problem occurs there is no dispute over pre-inception damage. It is also important not to “under insure”. When you insure a property, you need to ensure the cover is sufficient for the full repairs following an event such as a serious fire. The problem here is that if there are serious ground issues, the cost of solving these can be extremely high and can be more than the rebuilding cost and you don’t want to find you’re under-insured.

We dealt with a case where, following subsidence, a group of three properties had to be underpinned by installing a piled raft foundation. The ground conditions were very difficult and the costs of the remedial works were higher than the sum insured. The insurance company paid out the full sum insured, and then cancelled the policy. Without enough to pay for repairs and no on-going insurance the houses were effectively worthless. The client ended up having to pay out a significant sum to complete the repairs.

Subsidence and Selling Properties

If you have had a subsidence problem the best advice we can give you is…

DO NOT CHANGE YOUR INSURER AND DO NOT ALLOW YOUR POLICY TO LAPSE!

If the policy lapses, some insurers will not reinstate it, leaving you with no cover.

Normally if you change insurer, the only way you will be able to do this is to not declare the problem. That is fraudulent and means the policy is invalid.

On selling your property the insurance company either will assign the policy to the new owner or will issue a new policy but linked to the old policy recording the fact that there has been a subsidence problem.

The first option is best as it effectively means the same policy continues, just the name on the policy gets changed. This gives you the same rights as if the previous owner was still in residence. The latter option seems to be the more common approach which is acceptable, provided there are no adverse conditions imposed. When arranging cover for a new purchaser the insurers often like to make things difficult in the hope of not having to continue cover.

Often the first point of contact with the insurer will not be helpful and if necessary you will need to ask to speak to a supervisor. Normally once you get to speak to the right person the new policy is easily arranged. When arranging the transfer of cover make sure you do this on both buildings and contents cover. Both cover different aspects of subsidence so both must stay with the old insurer.

When arranging insurance, particularly if the subsidence problem is on-going, have it recorded that any on-going or future claim covers all the damage and not just new damage from policy inception.

We had one job where a house had major subsidence which was repaired and the house was sold. The new owner found some major issues with the works carried out (the living room floor was 75mm out of level!!) but when he contacted the insurer they said that as the works were prior to policy inception he had no rights for any further repair. If you are in this situation we recommend that you have the insurance checked by your solicitor to make sure there are no loopholes.

Subsidence and No Insurance

If the property has been repaired following subsidence, then generally even after the repairs none of the main stream insurers will insure the property. We can sometimes advise on specialist insurer who will take on properties like this providing it meets their criteria. Please contact us to discuss the problem.